Robinhood continues to make headlines

Robinhood just announced that it raised an additional $320million at the same valuation as the May $280million. This brings its Series F funding to $600 million and its post-money valuation to $8.6 billion.

Total funding since inception (2013) is $1.5billion

There isn’t another pure startup competitor of Robinhood in the US. We could look at Coinbase who is focused only on cryptocurrencies but has aa growing B2B offering in addition to their B2B offering. Coinbase has roughly one-third of the funding and a valuation of around $8billion.

In a way, we could say that Robinhood has also a B2B business because their revenues from selling order flow (especially options) is growing (see details below).

We could also look at savings Fintechs like Acorns that have also been growing and benefiting during these transformational times similar to other savings and investing apps. Acorns have only raised $207million to date and its valuation is may be approaching the $1billion.

As TechCrunch remarks, Robinhood has had growing pains this Spring and made headlines with less fortuitous news.

2020 pain points included app crashes, first time disclosure of sizable order flow revenues (look at the details), and more.

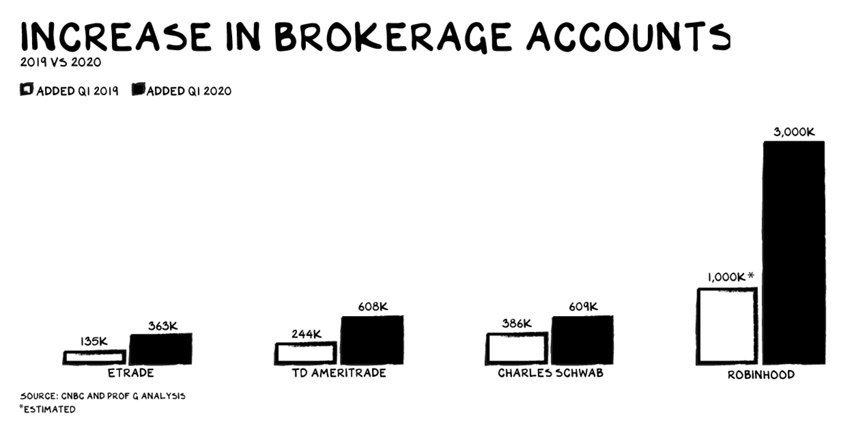

There is clear evidence that retail trading overall has been on the rise since 2019 and spike during Q1 2020. This is due to so much cash sitting around (M2 in the US is up 23% and we have to believe that some of it found its way into the stock market) and of course to what I have been calling the `Robinhood effect`. In plain words, the extreme commoditization of stock trading.

Scott Galloway is a clinical professor of marketing at NYU Stern university and a serial entrepreneur who has written a great article Robinhood Has Gamified Online Trading Into an Addiction Tech’s obsession with addiction will hurt us all. According to his estimates of the online trading activity rise (mostly based on the rise of account openings not the size of the trades or volume) it is clear that Robinhood is leading this trend. The increase for Robinhood is x3 times, Schwab is x1.6 times, TD Ameritrade is x2.5 times, and Etrade is x2.7 times.

I have not found any figures that support the narrative floating around that retail trading has had a significant or even leading contribution to the stunning US stock market rally since its bottom in mid-March.

The figures that we can report is that the order flow business was very strong in Q1 2020 and Robinhood`s revenues from selling order flow is leading the pack.

Alphacution was the first to report Robinhood`s hidden revenue stream last year. I wrote about this last November in Zero-commission brokers selling order flow are the new intermediaries. Who will disrupt them?

Now, starting 2020 there has been a new disclosure requirement around order flow business practices. As a result, we have concrete figures in hand from the entire industry, incumbents and fintechs.

Frank Chaparro reported in mid-June` New filing shows Robinhood brought in close to $100 million by offloading order flow in the first quarter`. So, Q1 revenues were $100million for Robinhood and Alphacution estimated $69miilion for the entire year of 2018.

I have two problems with these increased figures. One is the lack of transparency in terms of the Robinhood`s business proposition and monetization strategy. The narrative that has been left floating for years, is that Robinhood makes money from margin accounts and interest on cash. No Robinhood manager contradicted that or presented proudly their growing order flow business. And of course, since everybody else does it (except Fidelity) why not Robinhood. And this is where the irony comes in. How is Robinhood different than incumbents?

The second problem I have is that the details of the order flow disclosures (see here) show clearly that most of these revenues come from option trades rather than plain vanilla stock order. Needless to say that option trading requires more education and sophistication and is riskier than plain vanilla stock trading. And again all this didn’t matter until it did.

Sales of order flow from Robinhood`s option trades, outsize plain vanilla order flow revenues.

In addition, back in December 2019 when Robinhood got fined by FINRA for violation of best execution practices, it didn’t matter. The question is when will it matter?

I rest my case, as I have always had a big question mark next to the value proposition of Robinhood. Evidently, it is around the democratization of retail trading. But I have always struggled to come up with a solid argument on `Why` is this kind needed. I have yet to answer it. I do understand the `Why` for fractional shares, I do understand micro-savings into investing, crowd investing, social trading, etc. and other nudges that over time develop better personal financial habits around investing.

I also understand various DIY offerings but this Instagram like tool does not address any core financial need. We need to manage budgets, invest wisely, save, plan retirement. What big need is Robinhood and its future roadmap solving?

2020 will leave us with sad realizations around Instagram like capabilities for option trading and cynicism around trading bankrupt Hertz stock and the craze on Robinhood of the Electric vehicle stock NKLA.

Robinhood`s founder has committed to take care of the issues around options trading.

Commitments to Improving our Options Offering