Figure, the Lending new unicorn powered by Blockchain

During the last week of February, market indices dropped precipitously, wiping out trillions of dollars in a historic drop.

I kept worrying about the liquidity issues that robo-advisors could be facing, as I kept fresh in my mind the Betterment/Brexit incident in July 2016! When the unexpected British election results hit the market, ETFs became illiquid and mispriced and Betterment suspended trading for retail on that Friday of the Brexit results for almost 3 hours.

ETFs have been the bread and butter of all robo-advisors. As of the end of 2019, based on my calculations, incumbent and standalone robos accounted for 12% of the entire ETF market (see here). Both standalone fintechs and incumbents use these efficient wrappers to create their portfolios.

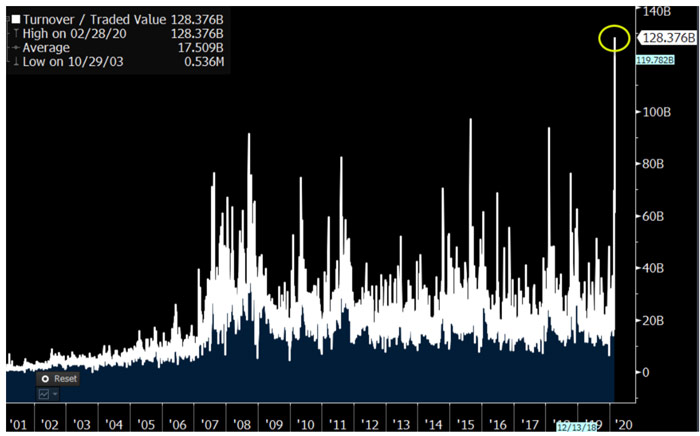

Eric Balchunas, reported that history was made on Feb 28th, with the $SPY ETF becoming the first security to ever trade in one single day, over $100billion!

SPY trading volume

Several large ETFs made all-time volume records on that same day. For example, $QQQ the NASDAQ tracker reached $28billion and $HYG, the most widely used high-yield bond ETF, reached $7.8billion daily volume.

Overall, the ETF market fared very well in this market blood bath.

The record volumes are a healthy sign. ETFs are used by professionals to get in and out of the market fast and efficiently. I say that the record volumes are a healthy sign, because they were combined with tight spreads and reasonable premium-discount levels; unlike the situation that occurred in the summer of 2016.

Authorized participants (APs) that manage the liquidity and play a significant role in the bid-ask spreads in ETFs, worked wonders in this recent market turmoil. In my 2016 post, I discuss in detail the liquidity risks inherent in ETFs. The bottom line is that the business of APs for ETF, is an operationally intensive business. The Aps create and redeem ETF shares and on average each ETF has 5 active APs. These are typically large US banks but also European banks are involved in the large US ETF market as APs.

We need to celebrate the way in which these entities handled the total record volume of ETFs this past week. $1.2 trillion traded in ETFs! Bank of America, Goldman Sachs, JP Morgan, and ABN AMRO, are some of the major AP players that make it possible for robo-advisors to brag about serving smoothly end customers.

ETFs proved themselves in the February downturn that goes down in history as one of the most severe drops in a short time. It has been compared to the 2008 crisis, as it wiped out close to $5 trillion in value in public stock markets.

ETFs overall experienced $24billion of net outflows! This is peanuts compared to the overall drop in equity values. This shows that that retail ETF holders, HODLed; the high ETF volumes indicate that professionals used ETFs to manage their exposures.

Stay tuned for a March update, by month end.

Appendix

ETF liquidity risks are more complex than at first sight.

There are ETFs that target illiquid markets (e.g. equity exposure to the Egyptian stock market; or specific bond market).

There are ETFs that simply don’t accumulate enough volume and therefore the bid/ask spread is wide. This is because the market maker is dealing with a narrow market. There are tons of ETFs that are low volume (close to 30% are reported to trade less than 5,000 shares per day!). Exchanges are giving out incentives to the trading firms involved in market making, to keep these structures alive.

There is also the Premium/Discount spread that reflects whether the ETF itself is trading above or below the NAV of the underlying portfolio. This can happen because of behavioral trends (i.e. the crowd pilling into an investment theme or an investment theme gapping down because of an event that turned it out of favor). This is the type of risk that Betterment tried to protect its clients from when it halted trading during the aftermath of the Brexit.

The last and least understood liquidity and counterparty related risk is one related to the Creation/Redemption process of ETFs. This is actually the secret sauce of these structures, which gives them the intraday liquidity which is lacking from mutual funds and the tax efficiencies. The Creation/Redemption process of ETFs refers to how the shares are created or redeemed. The process is complex and if one wants to understand it, it is explained on ETF.com here. The hidden risk that needs light shed onto it, is related to Authorized Participants (APs) who are the entities that create and redeem ETF shares and are sometimes the same as market makers; but not always. They are the usual suspects (large broker dealers) and have signed AP agreements with the ETF issuers (see a SEC-registered AP agreement here). In summary, for each ETF, one has to think of the Issuer (e.g. Vanguard, Blackrock), the Authorized Participant AP (e.g. Bank of America) and the Market Maker and the Custodian (e.g. JP Morgan, State Street).

So, one can say that at least Four kinds of liquidity risks are inherent in ETFs. The AP related risk or the risk inherent in the “magic” Creation/Redemption process of ETFs. It is a risk that cannot escape from a Lehman moment in the financial sector. Even if one invests in an ETF that has no direct exposure to the financial sector, through the double liquidity dependence on Authorized Participants and Market Makers of ETFs, the risk is there and real. In August 2015 when the market gapped, ETF prices were not available and active investors, those needing to hedge through ETFs; were facing a void. Passive investors focused on mirroring Indices, were disappointed too. Panic and behavioral biases can turn a seemingly well-functioning market into one that is illiquid, volatile and distorted. All these factors are concentrated in the financial sector. There is no difference from the time of the mortgage structured products crisis and the out of proportion domino effect.