Will Robo advisors take control of the ETF market?

Betterment and Wealthfront are 11 and 8 years old. They set the tone in the market for Robo-Advisors, that are neither Robots nor Advisors as Paolo Sironi kept saying more than 4 yrs ago. They got leapfrogged by the incumbents which as of today manage 10 times more assets through their various digital wealth offerings.

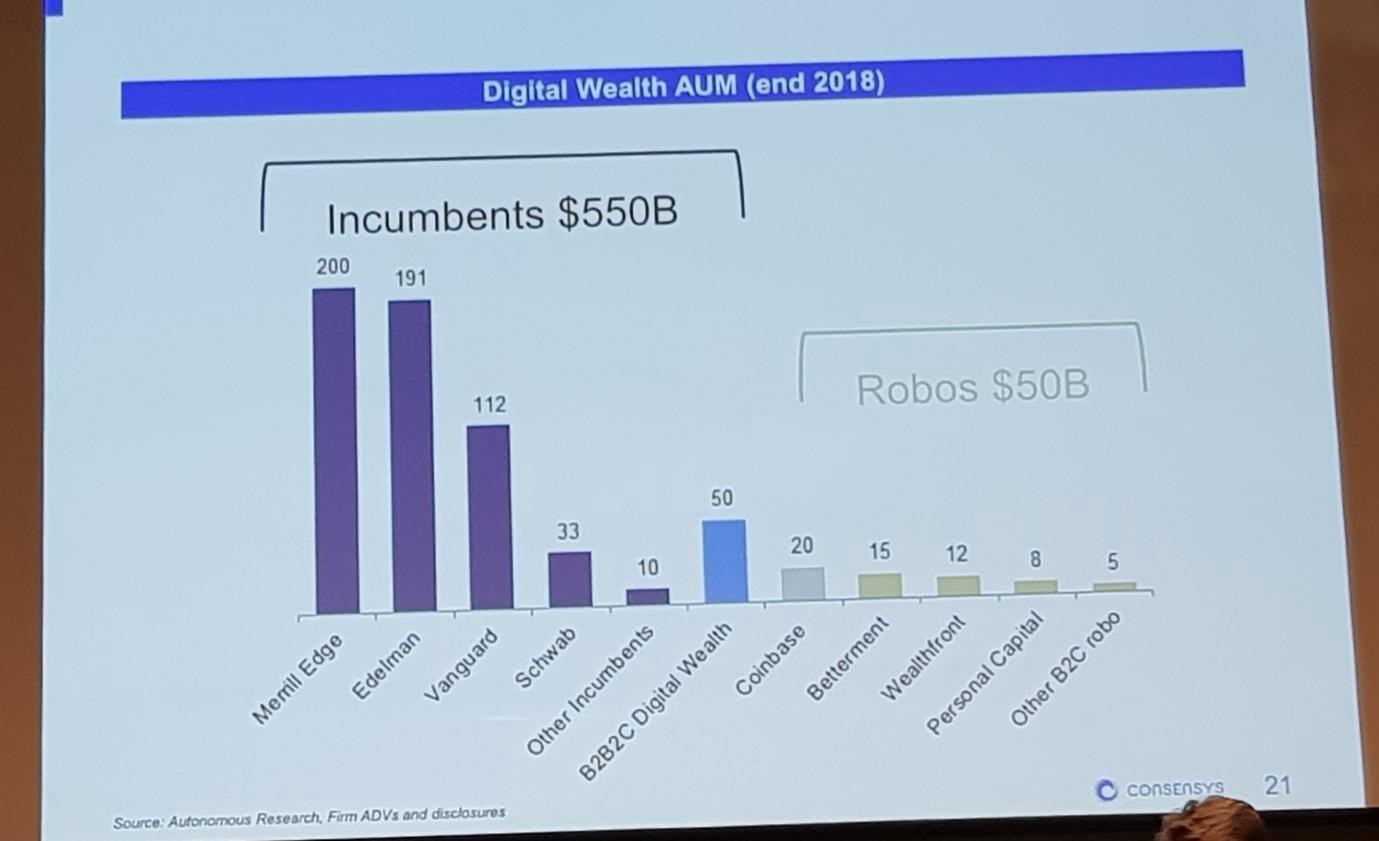

Autonomous Next Research [1] shows a ratio of $550 over $50, Incumbents over Fintech Standalones as of the end of 2018.

The tug-a-war between no-human advice (which was the original purists’ approach), hybrid (some human advice and or someone to call); has tilted towards the hybrid advisory model.

The tug-a-war of flat fees versus % of AUM; remains tilted towards the % of AUM which was the conventional one. Flat fee advisory have been offered by XY planning network and directly to the consumer only recently by Charles Schwab (see No Trade-offs: Give customers everything they want as cheaply as possible).

Back in 2016, just after Vanguard stepped into the market with their Personal Advisor services, most well-known institutions [2] were predicting between $ 2.2 trillion and $ 3.7 trillion in assets to be managed by Robo-Advisory services in 2020 and $16 trillion by 2025.

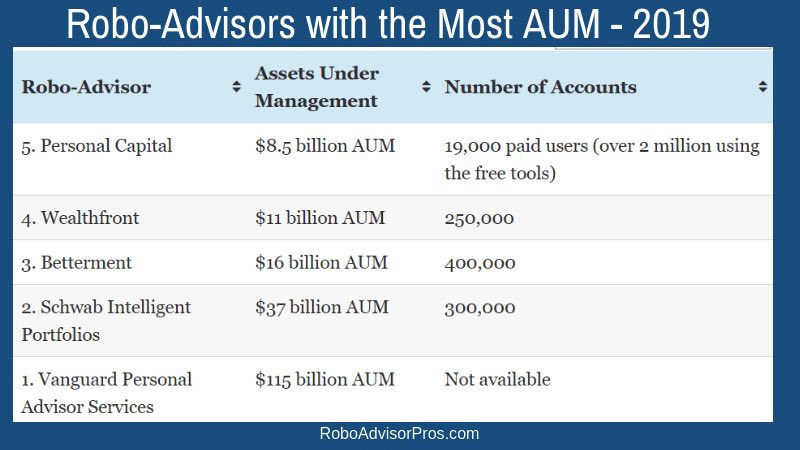

Well, 2020 is around the corner and we have not reached $1 trillion yet.

The customer remains king. They can get digital-only service for as low as 15bps (once Vanguard Digital is live) or for $30 per month a hybrid service from Schwab.

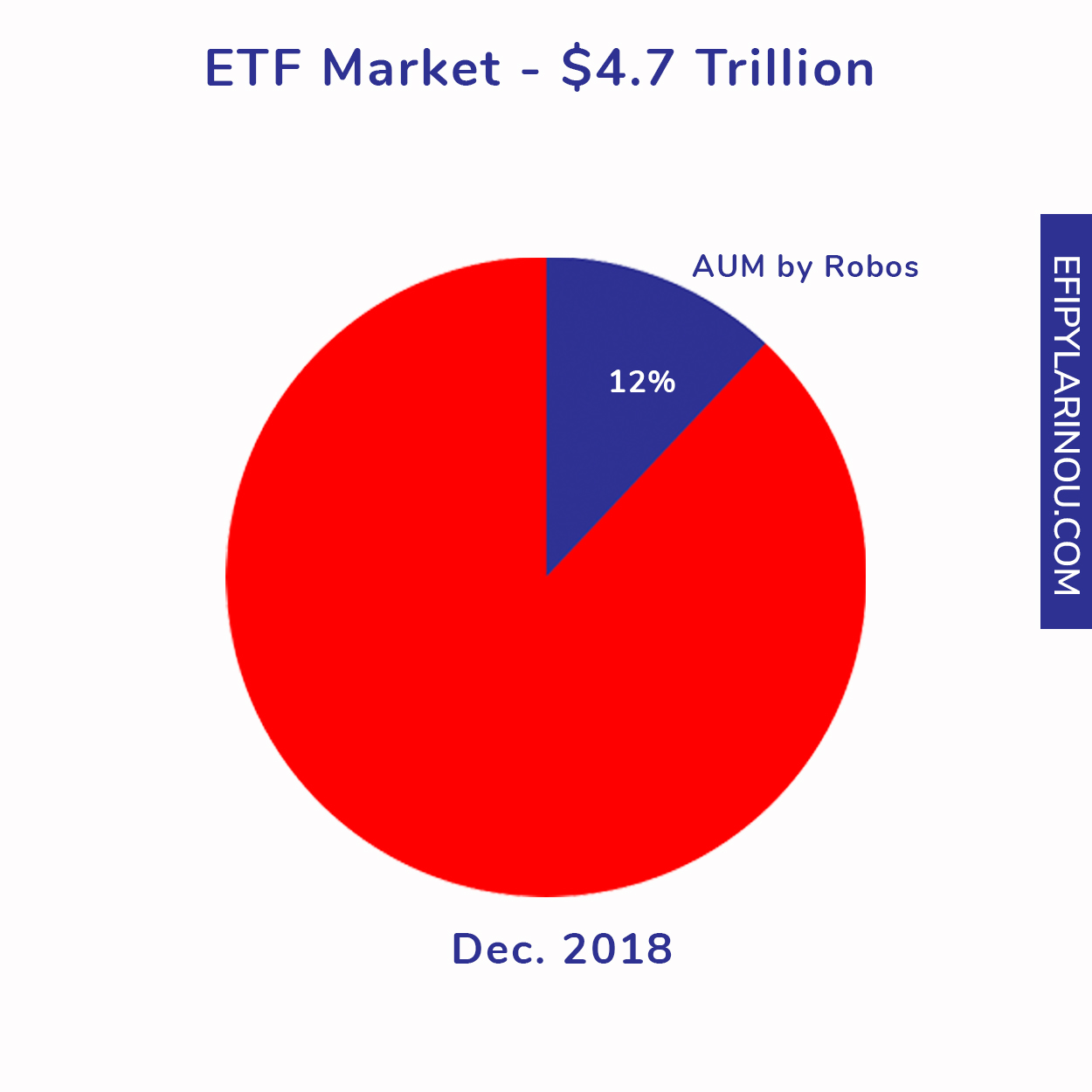

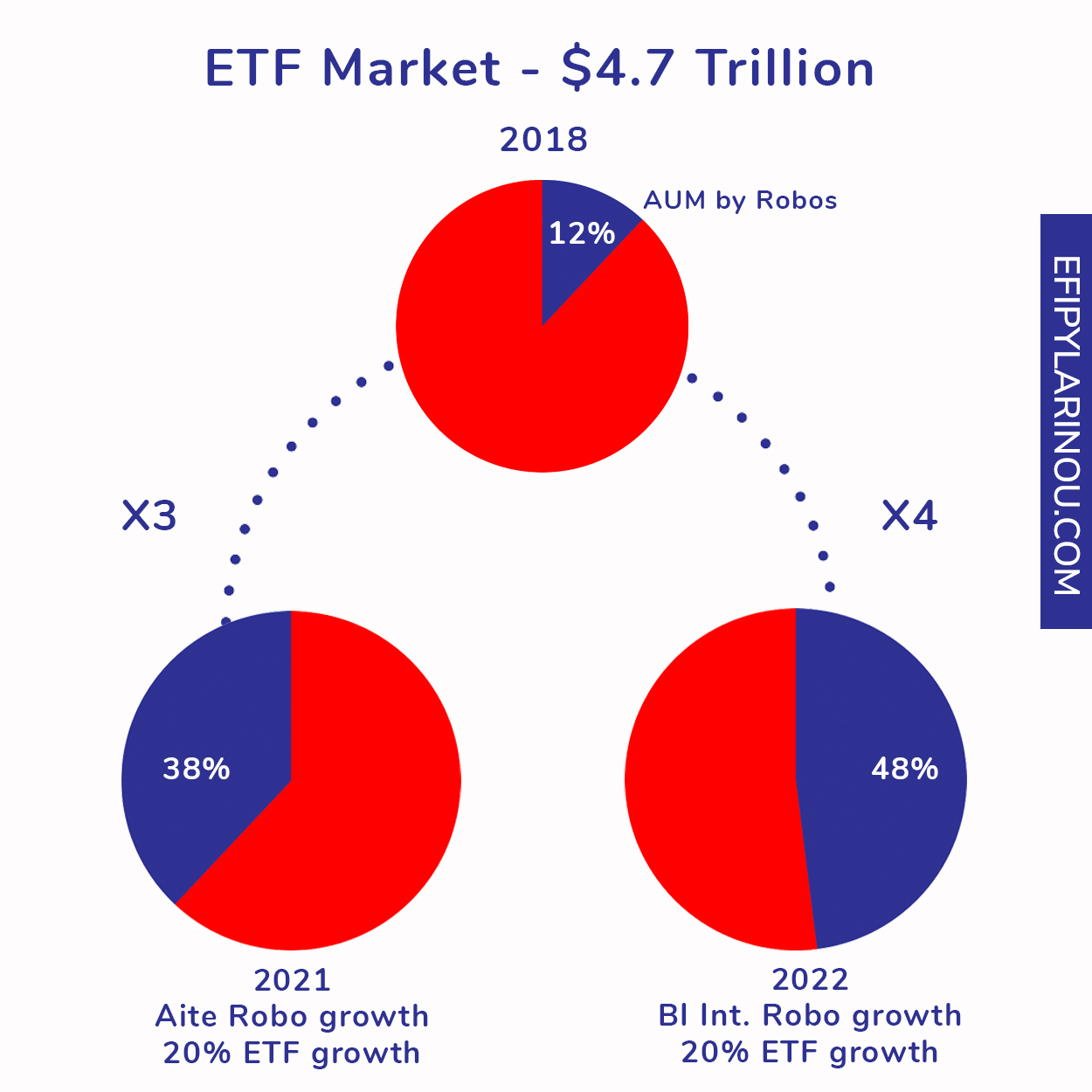

The ETF market, which is the main product universe that powers all digital offerings, has been growing and has reached $4.7 trillion. Digital wealth seems to be managing 12% of ETF assets (as of end 2018).

It took the ETF industry a decade to reach $1 trillion in assets (in 2010). But the pace of growth picked up significantly thereafter and averaged close to 20% per annum. Will this pace hold, if equity markets enter a bear trend?

Can digital wealth maintain or improve its 12% share of the ETF market?

The growth in their AUM only started to be meaningful from 2016 once Schwab and Vanguard stepped in. Edleman`s 2018 deal to buy Financial Engines, was another significant contribution to Digital wealth growth managed by robos.

Aite group`s research in 2018 predicted $1.46 trillion for 2021 and BI intelligence $4.6 trillion for 2022. [3] Aite`s numbers mean that Digital AUM needs to grow at a rate of 38% per annum from 2019–2021 to reach the $1.46 trillion by the end of 2021. If this materializes and the ETF market continues to grow by 20% (reaching $8.1 trillion), then Digital Wealth will be managing 18% of the entire ETF market.

In the more aggressive scenario suggested by BI intelligence, the implied growth rate for Digital AUM from 2019–2022, is 70% per annum from 2019–2022. If this materializes and the ETF market continues to grow by 20% (reaching $9.5 trillion), then Digital Wealth will be managing 48% of the entire ETF market.

[1] Infographic from Roboinvesting event in London, Lex Sokolin`s keynote. Other research groups don`t take into account Edelman and Merill Edge and therefore arrive at a lower number. Investopedia (Robo-Advisors 2019: Still Waiting for the Revolution) reports that as of mid 2019, $440 billion is managed by robo-advisory services according to Backend Benchmarking, and a $350 billion range is Aite Group`s numbers.

[3] https://www.financial-planning.com/news/3b-edelman-financial-engines-deal-puts-rias-in-hot-seat