The Crosslend & Solaris Bank partnership is key to the European debt Securitization market

Santander Innoventures has not been shy in investing in Fintechs in the lending space. Kabbage is one of their earlier and well known portfolio companies and strategic investments. Several others that offer banking services in Emerging markets, offer loans.

In October, they led a €35 million Series B round for Crosslend, a Berlin based startup offering a digital debt marketplace to securitize all forms of debt from banks and alternative lenders.

Securitization is still a tainted term even after a decade from the financial crisis.

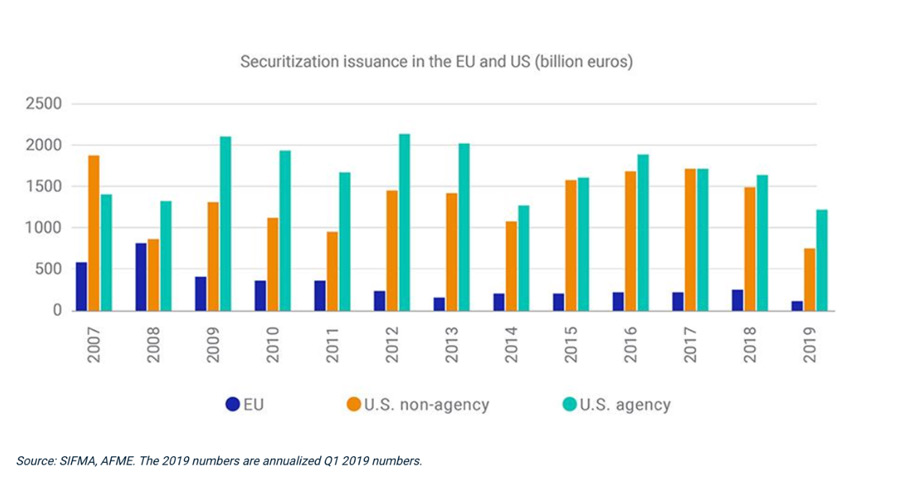

Sadly, the European securitization market has not recovered since 2007, whereas the US market seems to be approaching pre-crisis levels. The mix has changed in the US with a clear reduction in the non-agency market and an increase in the issuance of consumer asset-backed securities and collateralized loan obligations. Issuance in Europe approached in 2018 just one third of the 2008 peak issuance.

EU 2018 issuance = € 269 billion

EU 2008 issuance = € 819 billion

Both regions created new regulations after the crisis. The EU continues to develop new standards that the market awaits to adjust to. The STS — Simple Transparent Standardized — framework is the latest one under development. [1] Can we blame the regulators in the EU for the anemic growth in the EU securitization market?

This past June, Younited Credit, a French fintech marketplace for consumer loans, placed €156million in a public securitization listed on Euronext (Youni 2019–1). They are the first to get the highest rating on its “senior” tranche, rated AAA/Aaa by Standard & Poor’s and by Moody’s.

Funding Circle has also engaged this year in securitizing loans but through private debt placement deals. By July, Funding Circle had reached the total amount of loans securitised to £755m. Its latest transaction was rated AA / Aa3 ratings by S&P and Moody’s, respectively. [2]

So, where are the Fintechs to disrupt the complicated securitization process? Since the 1970s that securitization was designed and proved its product market fit, the pros for loan issuers are clear and pretty much unchanged.

Securitization for issuers, means off-balance-sheet treatment. It is a way to unlock capital as loans move off the originator`s balance sheet.

This can reduce capital at risk requirements for banks and replenish capital (potential to borrow at lower rates through higher credit ratings).

The reality is that the process is complicated and expensive. As a rule of thumb it starts making economic sense when pooling hundreds of million of assets. This is in itself is tough because there needs to be some homogeneity in the underlying pool (common sense but also regulatory standards). In addition, a new company needs to be setup, the SPV that will hold the pool, and legal and tax issues need to be addressed.

Crosslend a German fintech is taking a stab at this tough but highly scalable problem. A new of them from their early days, through one of their early investors, Lakestar. They aimed to be a Cross-border online lending platform for institutional investors and borrowers.

They have actually pivoted since and developed a solution to automate the securitization process of loans in siuch a way that it becomes worthwhile to securitize smaller pools of loans — between 20 and 100 million euros.

Their automation includes a with a high-quality data warehouse which maximizes transparency of the newly issued securities and keeps transaction costs low.

Their total funding is now €49million and includes strategic investors like Santander InnoVentures and ABN AMRO ventures.

The combination of Crosslend and Solaris Bank, the successful German Baas provider, can become one of the growth stacks that propel the CMU (Capital Markets Union) to the next level.

The CEOs of Crosslend and Solaris Bank (already in partnership since last year) are aiming to fully automate loan securitization with no cross-border frictions and create securitized pools for as little as 20million loans.

Using the Solaris Bank balance sheet to originate loans and the transparent automated technology of Cross lend, they aim to create a new model, `Digital Securitization as a Service`.

The partnership allows Solaris Bank to establish what they call ‘The Balance Sheet Light’ model. Loans are originated using Solaris Bank`s license. These can be passed on to investors with a small delay and without putting a long-term strain on the bank’s balance sheet.

“The Balance Sheet Light model is revolutionary. As a platform, we match supply and demand in the credit sector. At the same time, we maintain the flexibility to hold loans thanks to our banking license and can actively manage our balance sheet. With this approach, we can maximize the efficiency of our equity and make the securities market much more efficient and transparent.”

— Alexander Engel, CFO solarisBank

The Crosslend SolarisBank combo could become the technology that makes the STS — Simple Transparent Standardized- vision of the CMU reality.