Stash the robo-advisor with over $300million in total funding

The closing of the Motif and the timing of the $112million funding of Stash, have sparked interesting conversations.

Craig Iskowitz weaved a rich coverage of Motif`s story on May 1st with lots of data and back flashes on how Motif was perceived along its journey. 13 Roboadvisors That Might Become Victims of the COVID19 Crisis is a great read for anyone in wealth management. In the last part he shares a robo-advisor ranking in an effort to start thinking about who will not survive in these markets. The Ezra Group divided 38 providers into to three groups: Market Leaders, Up & Coming and Watch List.

I`ll just pick on the first group `The Market Leaders` only because it contains Stash who definitely has us all looking at why it was able to raise this large amount of funding (Series F) in these market conditions.

Craig includes in `The Market Leaders` the big old names of Vanguard and Schwab that are pure investing giants, along with micro-investing apps like Acorns and Stash and MoneyLion (which is more focused on banking and lending).

He makes a point about the large number of paying clients that these three apps are serving. 15+ million customers compared to 30 million Vanguard clients. These are numbers as of January 30, 2020. We have unofficial evidence already of a spike in account openings across all digital offerings. In the #ItzOnWealthTech Ep. 46: The Mad Rush into Digital Advice with Bill Capuzzi, Bill Capuzzi CEO of Apex Clearing mentioned that they saw a 200% increase in new account opening in March.

For Stash to stay on Craig`s list and to not disappoint their investors, they need to execute well on their re-bundling. They cannot afford to stay only in investing like Schwab and Vanguard. They already started their re-bundling in 2019 and effectively their roadmap to become a fuller stack. They used their Series E funding to partner with Green Dot`s Banking-as-a-Service and introduce a debit card. After one year they have acquired 750,000 banking customers and continue to pay up to acquire more.

Tearsheet reports that Stash reached $1 billion in AUM in February 2020, with 4 million customers on the platform (not clear how many are paying any subscription which ranges between $1-$9 per month with $0 minimum). On the Stash website, they report 4.3+ million customers. However, only 750,000+ are banking customers.

Meanwhile, most of the large standalone robo-advisors are also creating fuller stacks with personal finance offerings — saving accounts, debit cards. Betterment, Sofi, Acorns, and soon Wealthfront, are in the same game.

One of the Stash key recent investors is Lending Tree (unclear if they actually put in money or have a strategic partnership), so they must be planning to add credit to their services. With the dazzling choices of Baas and Saas offerings, there is no secret sauce for almost anything. The trick is the go-to-market strategy that can create network effects. And this is where maybe Stash has one first-mover advantage. Is the optional `Stock-Back` reward program that they also introduced last year something that has actually worked for them?

On May 1, Pulse 2.0 reported that `nearly $10 million Stock-Back rewards have been earned by Stash customers since the launch of the debit rewards program almost a year ago.`

Stash customers earn

`0.125% Stock-Back rewards on all of your everyday purchases and up to 5% Stock-Back rewards at certain merchants with Stock-Back bonuses`

If all $10million stock-back rewards were earned at 0.125%, then that translates to Stash having processed $8 billion in payments through their debit card. That is an average $10,000 per banking customer per annum. If all purchases were at the merchants with the special deals with Stash that gave clients an average of 2.5% stock-back, then it translates into $400million in payments and around $500 of purchases per customer.

Is all this worth the Stock-Back patent?

Stash keeps investing in their Stock-Back program. They introduced 200 more stocks for 2020. Their digital design allows them to change easily the amount of the reward and offer special deals for certain periods and target to different plans of subscription. For example in May, they increased their rewards for CVS, Netflix, Hulu, Spotify, Disney to stock-back rewards of 2% from the usual 0.125%. (Details here) Their picks obviously are the best way to build customer loyalty, as all these are top choices for most people during the lockdown. They also offered 3% for two Food delivery stocks, Seemless and Grubhub only for plus subscription customers.

This kind of customizable service is definitely Fintech innovation.

It would be good to know what percentage of Stash customers actually opt-in their Stock-back reward program. And then, what is the actual distribution of rewards that were paid out amongst the individual stocks like Amazon, Starbucks, Walmart, and the diversified fund which is paid out as a reward when you make purchases at merchants that are not publicly traded and on the Stash list.

Are business analytics of Stash customer behavior confirming that once a customer receives a reward in a stock, they actually become more familiar with the company and allocate more funds to invest in the company? This is the narrative that Stash is floating around as they report that they are seeing an increase in customer deposits. Stash is hinting that there are network effects from the Stock-Back Rewards into their investment business.

It is worth monitoring Stash to see

- Number of Banking customers growth

- Average account size growth

- The Stock-Back reward program growth

- What value there is in the Stock-Back patent they refer to

- Any new smart credit offering

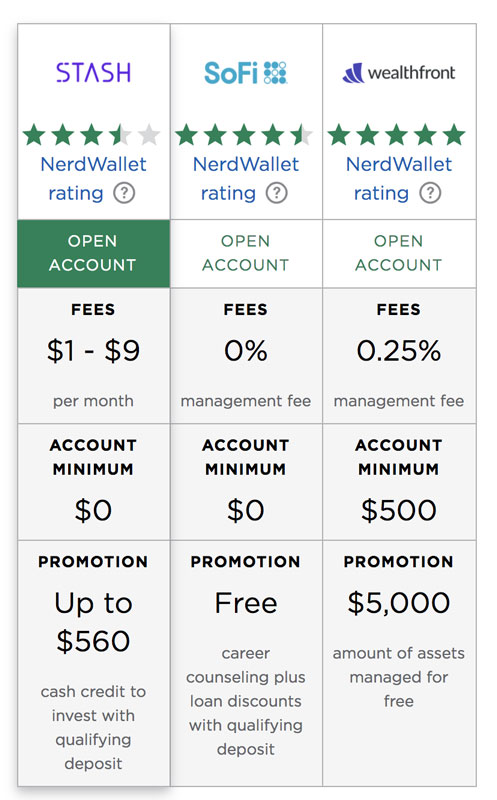

Nerdwallet April 2020 comparison shows that the customer acquisition cost for Stash is very high. They are still paying a lot to lure new customers.

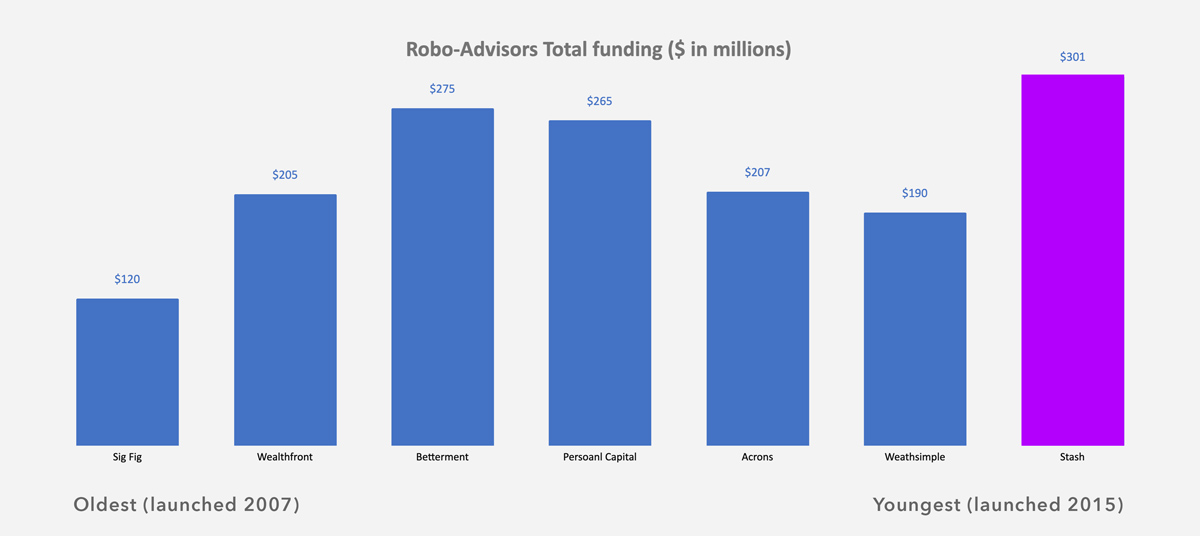

The US standalone robo-advisory space is on a journey of rebundling. Stash is the youngest of those that have made a name already and has just become the most well-funded robo-advisor with over $300million total funding.

To keep things in perspective, I have ranked 6 US robo-advisors with their total funding (and one originally Canadian) by age.

An earlier version of this article appeared on Daily Fintech.