Sustainable Finance and Investing, remains misunderstood. Language remains tricky, inaccurate, and subject to interpretation; which inevitably makes Mathematics the only Language that can be trusted (100% internally consistent) [1].

Looking at Sustainable investing, there are different approaches to qualifying.

- The first sustainable investors, negated sectors like tobacco. This is the exclusion approach.

- Then came a portfolio management approach, based on which ESG factors are used in traditional investment process always with the aim to optimize risk/return.

- Lately, impact investing is more direct and explicit, by choosing companies that aim to generate measurable environmental and social benefits (alongside the financial return).

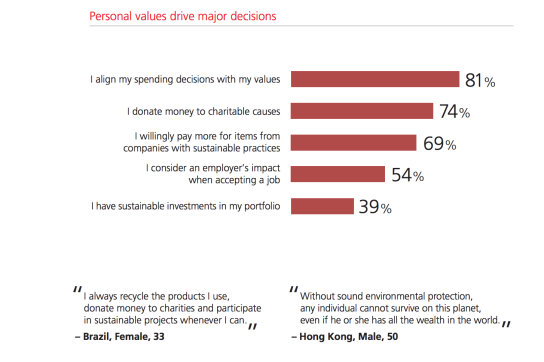

As I review a UBS Global Insights report (What’s on Investor’s minds, Vol.2, 2018) it struck me that Investing is lagging big time in the Shift in Values that is affecting other areas of our life. UBS looks at how our personal values (I would say, the shift in the hierarchy of our personal values) is driving major decisions in our lives. Their statistics show clearly that the Sustainability theme is driving our spending decisions, our willingness to pay a premium, our donations to charity, and even our choice of employment.

Source: UBS Global Insights report

Sustainability, however, factors considerably less (below 40%) in our investment decisions.

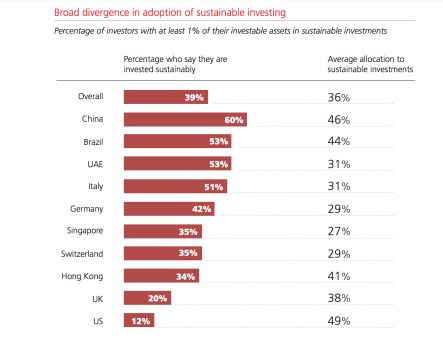

Sustainability investing varies considerably by market. The number of investors with more than 1% allocation to sustainable investments in Singapore and Switzerland are only 35% and China, Brazil, and the UAE + Italy, are in the 50s% and 60s% (probably more investors with smaller amounts).

Source: UBS Global Insights report

The expectation for growth is also very different. In the US and the UK, there are weak signs of a sustainable investment momentum. Whereas investors in the UAE and China, are largely convinced that this is the way to invest.

In Brazil, which has also a high sustainable investing adoption, there is a strong expectation that returns will outperform traditional investments.

Looking into the UBS report, it is clear that there is a lot of interest that is sitting on the sidelines and that advisors and influencers can play a major role in tipping these non-adopters over. We need to invest in converting these non-adopters because we cannot afford to continue borrowing from the future.

Join me, as I will be moderating a panel on Sustainable Finance at the Fintech+ event on October 1, in Zurich. I will be discussing with Sabine Döbeli, CEO of Swiss Sustainable Finance, Oliver Marchand, founder and CEO of CARBON DELTA, Anna Stünzi, researcher and co-lead of the foraus programme „Environment, Energy and Transportation“, and Rochus Mommartz head of Responsibility Investments. Come to participate in this exciting discussion, as I will be asking some tough questions around this topic that touches on a much broader issue:

Shift in values and technology

[1] A major topic that is worthy of a longer interactive discussion.