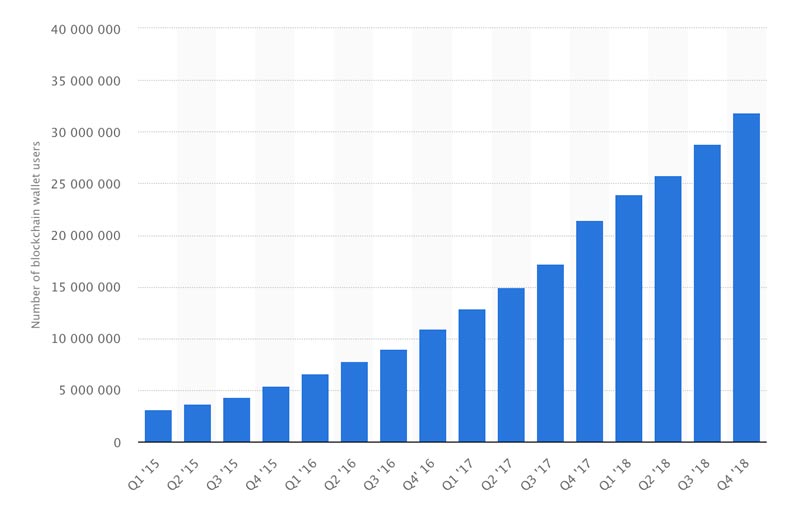

There are 32million Blockchain powered wallet users according to Statista as of Dec 2018.

While this growth is stunning, there are millions of people that still don’t understand the difference between these blockchain powered wallets and the digital wallets aiming to overtake the payment industry (replace plastic and other methods).

Wallets, purses, and handbags, have been female accessories and there is no sign of change on the horizon. Physical possession of IDs, credit cards, and cash, has been centralized in these accessories for ages. Men have been resisting the wrappers and filling front, back pockets of trousers or inside pockets of jackets. There is no adult that hasn’t been tormented by a misplaced, forgotten, or stolen “pack of personal” stuff (IDs, plastic, cash). Being able to take care of these possessions is a sign of maturity that any parent trains their teenager and delegates when it seems kind of safe.

The 24/7 mobile world seems to have moved part of the “pack of personal” stuff (IDs, plastic, cash) onto our smartphones. Digital wallets from Google, Apple, M-Pesa, and the likes are gaining traction and offering consumer banking kind of conveniences instead of cash and/or plastic. This is no shortage of mobile digital wallets even though end-users don’t seem to be spreading the word. I have yet to meet someone that looks at me in the eye and says “You cannot not have a mobile digital wallet! How can you live without that kind of accessory?”.

Some are counting on the fact that they are centralizing the multiple credit cards or store cards for us. Others are marketing loyalty programs either from our banking service providers or credit card providers or e-commerce stores. More recently, mobile digital wallets that aggregate and exchange value across various loyalty programs market themselves as creating more value with such interoperability.

All these kinds of Digital wallets are simply a digital interface to access centrally managed accounts through a mobile phone. There is no genuine innovation in these kinds of services since security issues inherent to centrally managed accounts remain and the cyber vulnerability of such third-party trust mechanism is not mitigated. The costs that these third-parties incur in order to handle the promises of maintaining deposits and accounts, keep increasing.

True wallets are those that enable each of us to hold bearer assets (like cash or cryptoassets) without needing a central third party to hold and possess these assets, and at the same time be able to transact with these. The true innovation here is removing institutional risk.

The finance future that is being built right now is offering the ability to hold any digital bearer instrument directly.

A user’s wallet will be able to hold a variety of financial instruments; cash, equity in a company, commodities, or even non-monetary instruments such as identification documents, school records, and driver’s licenses.

This world is the one that Jaxx and Shapeshift are shaping up. Their wallets aren’t just an interface to a bank. Their wallets are not just another account with an institutional provider. They aim to offer control directly to us and we can choose to trust our smartphone, our hardware wallets (Trezor, Ledger etc), or our hard copies etc.

Once they manage to scale, they will become the darlings of the regulators because who doesn’t dream of a world with reduced cyber institutional risk. The world of this next decade, will get rid of the need for reconciliation between financial service providers, a complex, and expensive process.

Fintech innovation started as a war between start-ups and financial institutions. This culture is clearly not the flavor of the day anymore.

Today we are seeing the emergence of another type of race. Will it be some branch of AI that solves the complex problems around legacy financial processes (like reconciliation between financial providers or vulnerabilities of accounts etc)? Or will it be cryptography that replaces centrally managed processes all the way from central banks to financial service providers?

The Digital Wallet User Experience will have to pass the toothbrush test.In “Consumer Banking”

7 mega waves in the Blockchain Economy and the dams holding them back In “Bitcoin & Blockchain”

Blockchain Digital ID and the vision of a Refugee Bank In “Bitcoin & Blockchain”