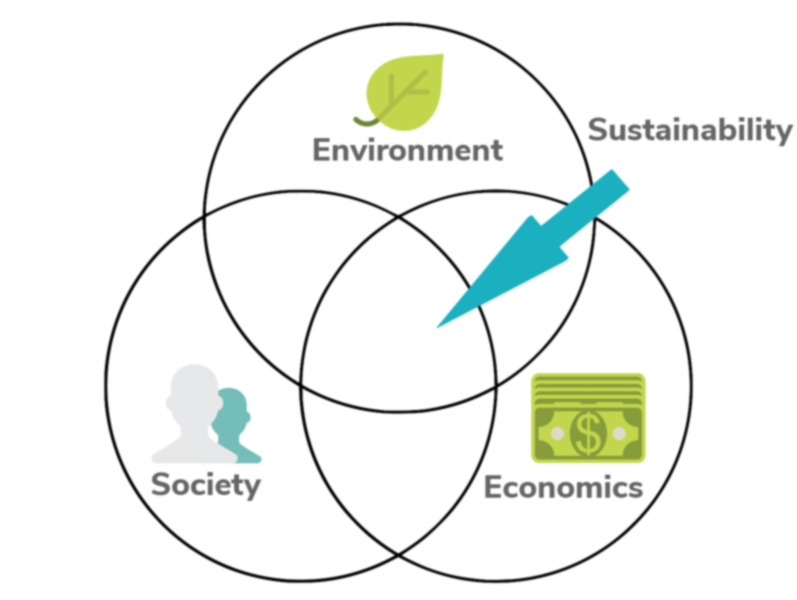

‘Globalization 4.0’ was the theme of the World Economic Forum this year. Naturally, the future of work, sustainability and smart technologies and living, were amongst the topics addressed.

What struck me was that the Davos crowd clearly ranks Jack Ma as the only visionary leader. This is the first time that someone from the East wins the hearts of the global business world which has long been dominated from the developed Western world.

This is the business man that has made Techfin reality. This is the business man that was an outsider to a controlling political system and who has become wise in a Yoda like way.

Just before taking the trains to Davos, I saw the announcement that Alibaba bought the German-based Greek starup, Data Artisans, founded by Greek entrepreneur Kostas Tzoumas. The company specializes in the fields of data analysis, fraud detection and direct communication with consumers. Its customers include Netflix, Uber, Zalando, ING, and Alibaba.

When I looked at all the other acquisitions that Alibaba made in 2018, five in total, they are all related directly to e-commerce for various products. Data Artisans is a clear data play and the other related acquisition that I could spot over the past two years was Visualead, a software company focused on the research, development and enablement of IOT technologies using Visual QR Code.

Only when I came back from Davos and looked into Data Artisans, did I realize that Alibaba was one of Data Artisans clients before being acquire, but most importantly that it is an Open source Big data technology company!

Apache Flink is the open source stream processing framework developed by Data Artisans that unifies real-time event-driven applications and real-time analytics.

Alibaba has contributed to Flink code over the past 2 yrs.

`Stream processing is the processing of data in motion, or in other words, computing on data directly as it is produced or received.` excerpt from Data Artisans

Stream processing trained by an e-commerce giant

+

IOT future of smart citiesis the killer combo

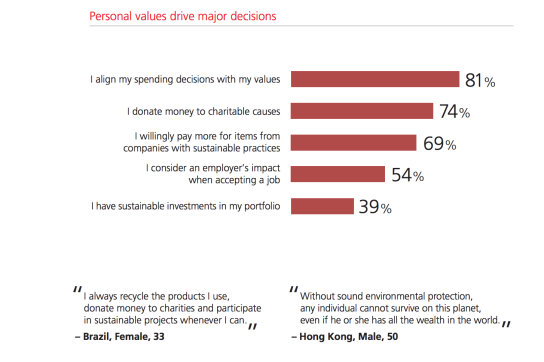

Jack Ma`s recent yodaism has been focused on smart people, management of people, and human superiority. While there is no way to hack his success, there are many insights to gain from the narratives he chooses to share in important events like the WEF.

Personally, I have been contemplating on the title of the Penny Power`s new book `Business is personal` (I haven’t read it yet). As a result, I was drawn to Jack Ma`s comments during the WEF around people and business.

“When I hire people, I hire the people who are smarter than I am.”

“To manage smart people you have to use culture, the value system, [so] they believe [in] what they do. If you just want to use rules and laws and documents to control and discipline them – that’s how you control stupid people,”

Jack Ma is devoting now his time in educational work. We have to wait to see what that means. In the meantime, the forked version of Apache Flink, is called Blink, and is capable of handling the requirements of such a large scale platform like Alibaba. Blink is running on a few different clusters, and each cluster has about 1000 machines. Real Times processing, search capabilities, and machine learning at this scale, is not a trivial computational task.

Open source technologies have to become the basis of the 4th industrial revolution which includes IOT. Alibaba is already working on designing that future.

Jack Ma, has departed from Alibaba, but the people listen to him. He still believes and preaches that we people have hearts that can`t be built in machines. His comments on smart people and managing them in teams, made me ask again the open question:

Q – `How far can decentralization go in our society?`

A1 – Does this need smart people to collaborate? A difficult task.

A2 – Will this happen because smart people don’t collaborate? An oxymoron.

Rethinking is what we all need to do.

Listen also to the thought provoking discussion of Dr. Guenther Dobrauz-Saldapenna and the `Rock`n`Roll Plato` Anders Indset in `Outhink the Revolution`.

“Our Leaders of today need the philosophy of the past, paired with the scientific knowledge and technology of tomorrow” – Anders Indset