Robo-advisors increase AUM but the Cash pile in the market hasn’t decreased

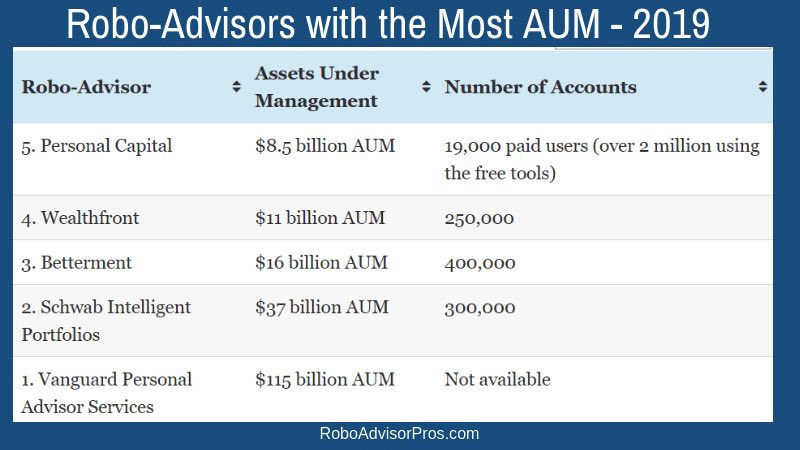

The top five robo-advisors have accumulated over $187 billion in AUM.

Two incumbents and three Fintechs are leading.

Growth in asset gathering continues but as per Autonomous Research, the jury is out as to whether gathering assets or gathering users are good measures of success of robo-advisors.

The growth has been double-digit, the kind that VCs like. Despite the fact that robo-advisors have clearly not lowered the customer acquisition cost (CAC) and ironically, in most cases have been deploying the same old-fashioned channels to acquire customers; VCs have been generous in funding them. Just for the top three Fintech robo-advisors, Betterment, Wealthfront, and Personal Capital VCs have invested ($275, $204, $265) nearly $745million.

The market share (as measured by AUM) amongst the top 5 US robos, is 20%-80% between Fintechs and incumbents.

One of the metrics that I had chosen to follow from the very beginning of the robo-advisory trend, was Unadvised Assets – cash in physical wallets and in checking & savings accounts. For me, Unadvised Assets are a measure of the market opportunity for robo businesses. Deloitte reported in 2014 that in the US there were close to 13 trillion of such, unadvised assets.

Looking at the Q3 2018 U.S. Federal Reserve report and recent Money data, from grandmothers to hedge funds holding cash, in overnight money market funds, to checking accounts and currency; I realize that the AUM served from robo-advisors have had none or negligible impact on Unadvised assets.

In the US, Unadvised assets continue their solid growth. In 2016, I had reported $13.4trillion and now we are looking at $14.5trillion. An 8+% growth over the past 3yrs.

Unadvised assets in the Euro area, have grown from a total of 10.3 trillion EUR to 11.8 trillion EUR – a 14+% growth over the past 3yrs.

In the UK, from 1.56trillion GBP to 2.4 trillion GBP – a 5+% growth over the past 3yrs.

Cash continues to be up for grabs, for robo-advisors, for P2P lenders, for crowdfunding platforms, and tokenization platforms.

It was in 2015 that Schwab and Vanguard stepped into the robo-advisory market and leapfrogged the standalone top US robo advisors, Betterment, Wealthfront, and Personal Capital. SigFig was also a big contender at the time but has pivoted since into a predominately B2B business.

Now we are 4 years later and neither the cash pile has been reduced, nor the Customer acquisition cost has dropped. Robo advisors have cannibalized the onboarding, asset allocation part of the investment cycle.

First the audience, then the sale.

— Efi Pylarinou (@efipm) May 3, 2016

For new robo-advisors to succeed now, they need a user base first https://t.co/XAYGNwNYY1 @MichaelKitces

[1] Advertising, mailing services, cheap initial offers….

[2] https://www.federalreserve.gov/releases/z1/20181206/z1.pdf